ri tax rate income

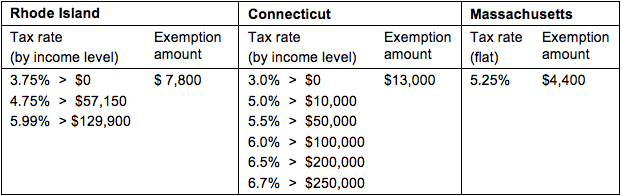

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to. Cities and counties do not.

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

2022 Child Tax Rebate Program.

. RHODE ISLAND TAX COMPUTATION WORKSHEET RHODE ISLAND TAX RATE. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Rhode Island collects a state income tax at a maximum. Rhode Island Income Tax Calculator 2021 If you make 70000 a year living in the region of. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375.

Overview of Rhode Island Taxes. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. 4 rows The Rhode Island Income Tax.

3 rows Rhode Island state income tax rate table for the 2022 - 2023 filing. Rhode Island collects a state income tax at a. In a program announced by Governor McKee Rhode Island.

The Rhode Island Single filing status tax brackets are shown in the table below. Ad Register and Subscribe Now to work on your RI DoT Form RI-1040NR more fillable forms. 2022 Child Tax Rebate Program.

In a program announced by Governor McKee. Complete Edit or Print Tax Forms Instantly. Ad Are you trying to file your taxes but need a 1095A.

The Rhode Island Income Tax. Ad Access Tax Forms. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Ad Access Tax Forms. There is a single statewide sales tax rate in Rhode Island of 7.

9 rows Our income tax calculator calculates your federal state and local. Complete Edit or Print Tax Forms Instantly. Rhode Island has a progressive state income tax system.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This page contains references to specific Rhode Island tax tables allowances and thresholds. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is.

Ad Are you trying to file your taxes but need a 1095A. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

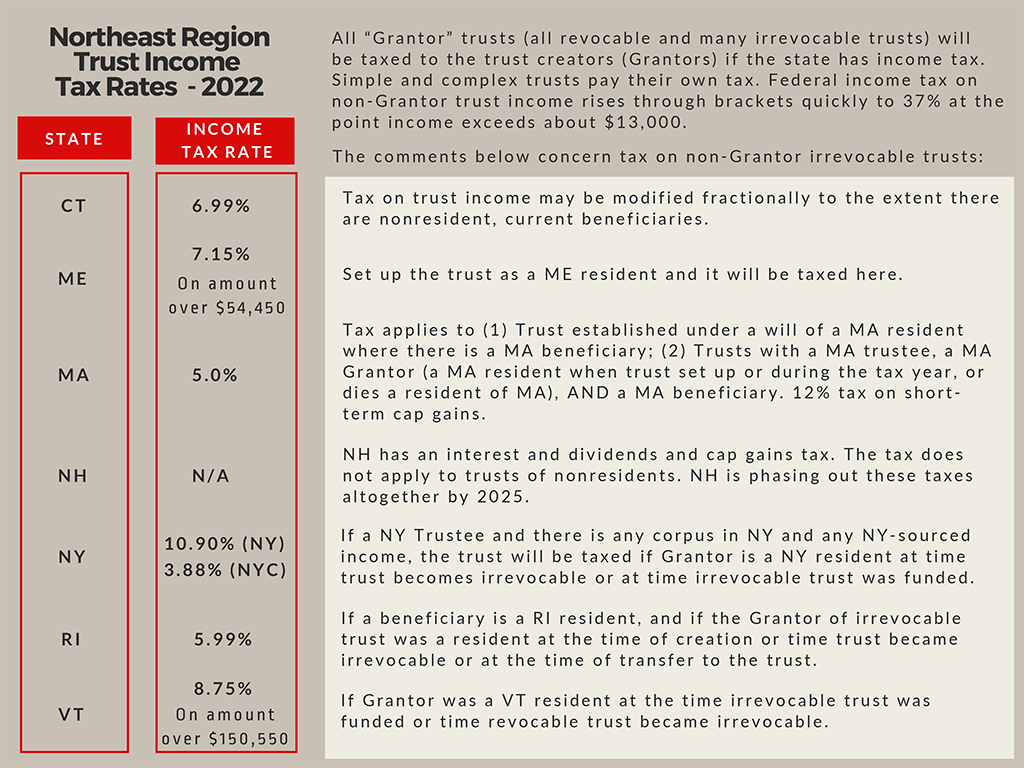

Trust Income Taxes Guide For The Northeast Borchers Trust Law

Rhode Island Income Tax Ri State Tax Calculator Community Tax

/images/2022/01/18/individual-tax-rates-by-state.png)

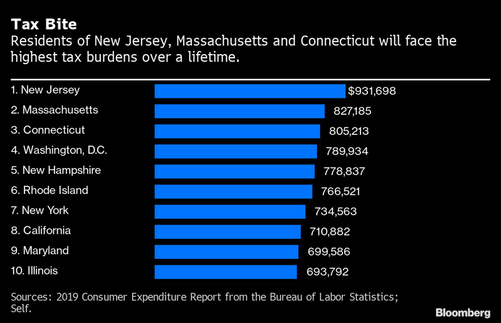

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

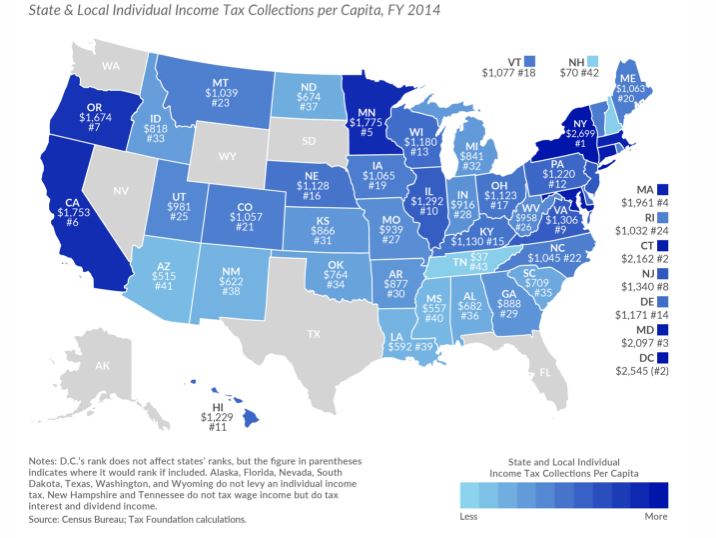

R I State And Local Income Tax Per Capita 2nd Lowest In New England

How Do State And Local Property Taxes Work Tax Policy Center

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Golocalprov Ri Has The 5th Highest Tax Burden In U S

Federal Tax 58k Salary Example Us Tax Calculator 2023

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

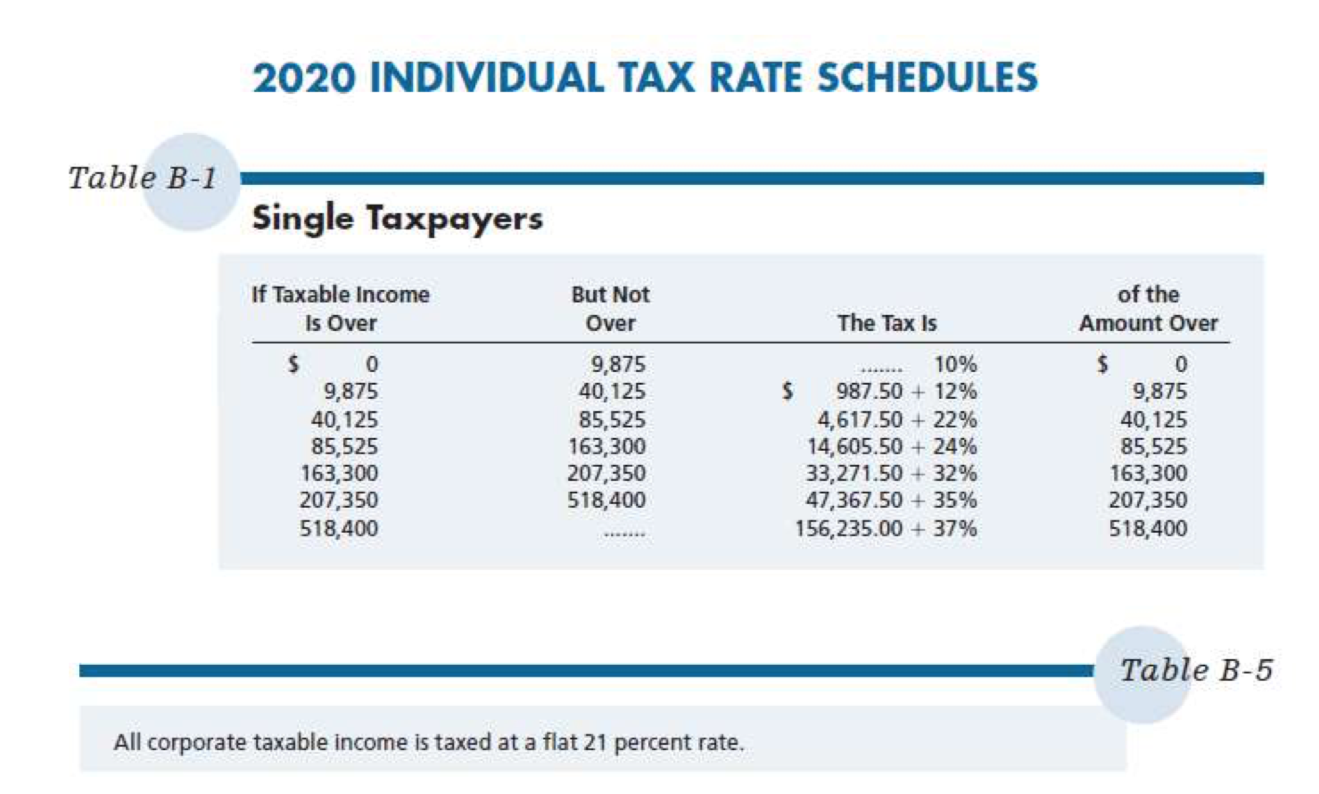

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Do Citizens Vote With Their Feet How Taxes Affect Where People Choose To Live

All 50 States And Dc Ranked From Least To Most Taxed

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

Revenue For Ri Kicks Off Campaign To Tax The One Percent

New Jersey Taxes Newjerseyalmanac Com

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov